German Tax

Publish date: Sep 15, 2019

Last updated: Apr 22, 2020

Last updated: Apr 22, 2020

IMAGE GALLERY (3)

German tax system is progressive tax system

- No tax until

9000euros annual - Than varies from 14% to 42% at

54000euros1 - Calculate online tax at2

- Tax classes from

1- singles to6- more than 1 job - Variables for Taxes

- Children

- Maritial status

- Church tax 9%

- Public / Private health insurance

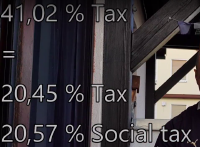

- Total tax 41.02%

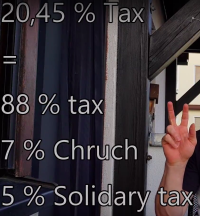

- Income Tax 20.45%

- 88% main tax

- 9% Church Tax

- save it by opting NO religious institute

- Solidarity Tax 5%, Rebuilding east germany

- Social Tax 20.57%

- Health 40%

- 50 / 50 % split between employer and employee

- Retirement 45%

- Jobless 7.5%

- Care 7.5%

- Health 40%

- Income Tax 20.45%

- Other Taxes

- Food 7%

- VAT 19%

- TV/Radiotax 17.5%

- Investment Tax 25%

- Property Tax

- Inheritance Tax

Online service to pay taxes.

Footnotes